The Impact of Offshore Money Centres on International Company Operations and Conformity

Offshore Finance Centres (OFCs) have actually become essential in shaping global business procedures, supplying unique benefits such as tax obligation optimization and regulatory versatility. The raising global focus on compliance and transparency has presented an intricate array of difficulties for services looking for to utilize these centres.

Comprehending Offshore Financing Centres

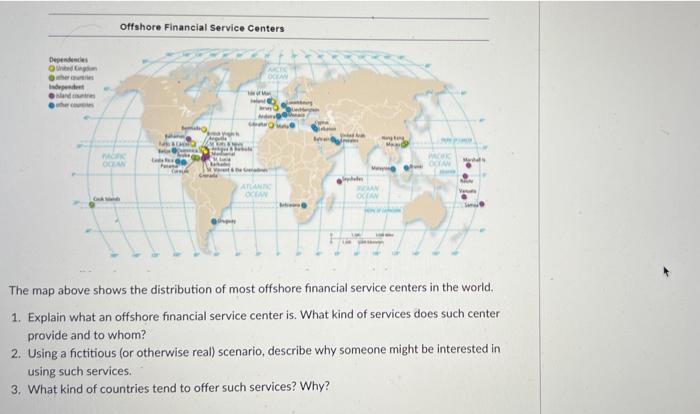

Offshore financing centres (OFCs) serve as critical hubs in the global financial landscape, helping with international business purchases and financial investment chances. These jurisdictions, typically defined by favorable regulatory settings, tax obligation rewards, and confidentiality laws, attract a varied selection of monetary services, consisting of investment, financial, and insurance coverage management. OFCs make it possible for companies to optimize their economic operations, take care of danger much more properly, and accomplish greater versatility in their financial approaches.

Generally situated in regions with reduced or no taxation, such as the Caribbean, the Network Islands, and particular Oriental territories, OFCs give a legal structure that enables companies to operate with relative convenience. They commonly have robust economic facilities and a solid focus on confidentiality, which interest international companies and high-net-worth people seeking to shield their assets and get to international markets.

The operational structures of OFCs can vary substantially, affected by local laws and international conformity criteria. Comprehending the distinct attributes of these centres is important for businesses seeking to browse the complexities of worldwide money (offshore finance centres). As the global economic landscape develops, OFCs remain to play a significant function fit the methods of businesses operating across borders

Benefits of Using OFCs

Using offshore money centres (OFCs) can significantly enhance a company's financial effectiveness, especially when it pertains to tax obligation optimization and regulatory flexibility. One of the main benefits of OFCs is their capability to use positive tax obligation routines, which can cause considerable cost savings on corporate taxes, resources gains, and inheritance tax obligations. By purposefully alloting revenues to jurisdictions with lower tax obligation prices, business can improve their overall economic efficiency.

Additionally, OFCs commonly present structured governing atmospheres. This decreased bureaucratic worry can assist in quicker decision-making and more dexterous service operations, permitting companies to respond swiftly to market adjustments. The regulative frameworks in several OFCs are created to attract international investment, giving services with a conducive setting for growth and development.

Furthermore, OFCs can work as a critical base for international procedures, enabling business to accessibility global markets much more effectively. Boosted privacy measures likewise shield sensitive economic information, which can be critical for preserving affordable advantages. Generally, the use of OFCs can produce a more efficient economic structure, supporting both functional efficiency and tactical organization objectives in a worldwide context.

Obstacles in Compliance

One more major difficulty is the evolving nature of global policies targeted index at combating tax evasion and cash laundering. As governments tighten up scrutiny and boost reporting demands, companies have to stay dexterous and notified to stay clear of penalties. This demands ongoing financial investment in conformity resources and training, which can stress operational budget plans, specifically for smaller sized ventures.

Additionally, the assumption of OFCs can create reputational dangers. Companies operating in these territories may face skepticism regarding their intentions, leading to potential issues in stakeholder relationships. This can adversely affect consumer trust fund and investor confidence, additional making complex conformity efforts. Eventually, services have to carefully navigate these difficulties to make sure both conformity and sustainability in their global operations.

Regulatory Trends Impacting OFCs

Recent regulatory trends are considerably reshaping the landscape of offshore financing centres (OFCs), compelling companies to adapt to an increasingly strict compliance atmosphere. Federal governments and worldwide companies are carrying out durable measures to enhance openness and combat tax evasion. This shift has actually brought about the adoption of efforts such as the Typical Reporting Standard (CRS) and the Foreign Account Tax Obligation Conformity Act (FATCA), which call for OFCs to report monetary details regarding international account owners to their home jurisdictions.

As conformity expenses increase and regulative examination escalates, businesses making use of OFCs must navigate these changes carefully. Failure to adjust can cause serious charges and reputational damage, underscoring the significance of proactive compliance strategies in the evolving landscape of overseas money.

Future of Offshore Financing Centres

The future of offshore finance centres (OFCs) is positioned for substantial improvement as progressing regulative landscapes and shifting international financial characteristics reshape their role in global service. Boosting pressure for openness and conformity will test standard OFC models, discover this prompting a change towards better responsibility and adherence to international criteria.

The fostering of digital modern technologies, including blockchain and artificial knowledge, is expected to redefine just how OFCs run. These innovations might improve functional effectiveness and boost conformity mechanisms, permitting OFCs to provide even more protected and clear services. As international financiers look for jurisdictions that focus on sustainability and company social responsibility, OFCs will certainly require to adapt by welcoming lasting money concepts.

In feedback to these patterns, some OFCs are expanding their solution offerings, relocating beyond tax obligation optimization to include wide range management, fintech services, and advising services that align with worldwide ideal practices. As OFCs develop, they have to balance the need for competitive benefits with the need to adapt tightening guidelines. This twin focus will ultimately identify their great site sustainability and significance in the global business landscape, ensuring they remain important to international economic procedures while also being responsible corporate residents.

Final Thought

The influence of Offshore Finance Centres on international company operations is profound, offering numerous benefits such as tax effectiveness and streamlined processes. As international criteria advance, the functional landscape for companies making use of OFCs is altering, necessitating a critical method to ensure adherence.

Offshore Money Centres (OFCs) have come to be critical in forming worldwide business procedures, offering special advantages such as tax obligation optimization and regulatory versatility.Offshore finance centres (OFCs) offer as pivotal hubs in the international monetary landscape, promoting worldwide organization deals and financial investment opportunities. Generally, the use of OFCs can produce an extra effective monetary structure, supporting both functional efficiency and tactical organization objectives in a worldwide context.

Browsing the complexities of compliance in overseas money centres (OFCs) presents considerable obstacles for businesses.Recent governing fads are substantially improving the landscape of offshore finance centres (OFCs), compelling companies to adjust to a significantly stringent compliance atmosphere.